MinIO wants to be the smartphone camera of object storage — in that millions of smartphone cameras destroyed the traditional camera industry.

Consumers have largely stopped buying cameras because smartphones can take pictures more easily, cheaply and quickly. Likewise, when virtually every organisation on the planet has access to open-source MinIO object storage software, MinIO hopes to become the default choice for object storage projects.

How widespread is MinIO’s software? It has had 622 million Docker Pulls — up 90 per cent year-on-year, with nearly a million occurring each day. A Docker Pull is a MinIO software download from a registry. Thirty per cent of the Pulls are in North America, 30 per cent in Europe, The Middle East and Africa, 20 per cent in the Asia Pacific region, and ten per cent in Latin America.

The true number of downloads will be even higher. Co-founder and CEO Anand Periasamy told us in a briefing: “That only represents public adoption. Private ones are hidden.”

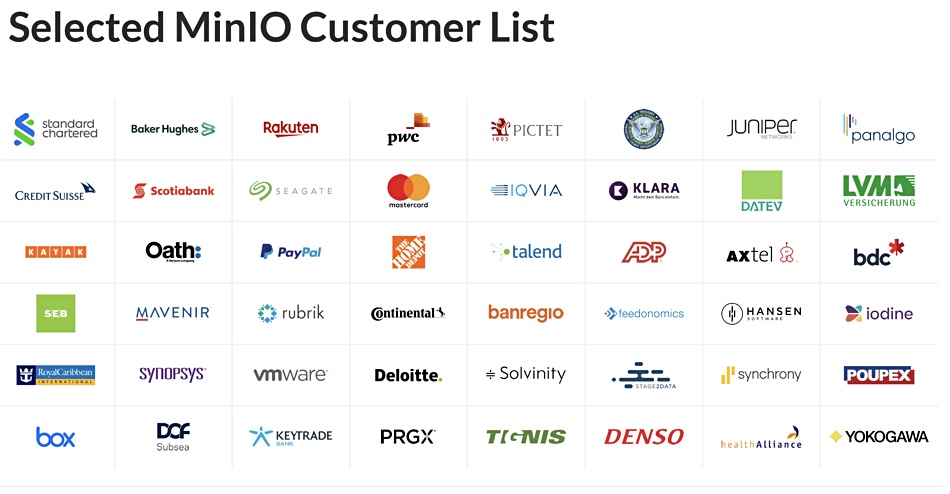

We think MinIO sees itself penetrating the object storage market from the bottom up. Its software is simple to obtain, clean to use, capable, cloud-native, S3-compliant, reliable, scalable and very fast. Many storage vendors use it to provide an object storage add-on or gateway to their products. For example, VMware, Seagate with Lyve Cloud, and Pavilion Data.

In effect VMware, Seagate and Pavilion have validated MinIO’s software.

Object storage is assuming a more important role in IT, and that rising tide lifts the MinIO boat as well as those of Cloudian, DataCore, Dell EMC, IBM, NetApp (StorageGRID), Scality and other suppliers.

MInIO everywhere

Periasamy told us “Object storage is now competitive for database work. Kubernetes primarily looks for object storage. The AWS S3 giant — $45 billion of it — is squeezing out the object players, with only a handful of pure-play object vendors left. Object is changing everything and we’re a major player in this space going forward.

“You have to be available every where, on-premises and in the public cloud. It’s what differentiates us. We have more than 500,000 hosts across AWS, Azure and GCP. Cloud customers adopt us because we have multi-cloud portability.

We’re the only object storage company present everywhere. We’re available with Kubernetes, SUSE, HPE’s Ezmeral, VMware Tanzu, OpenShift and in the Alibaba cloud.”

The idea would seem to be that Cloudian, Scality and the others have sold comparatively large orders to enterprises while MinIO has made its SW freely available to enterprises and everybody else. It’s penetrated into the pores of the whole global IT ecosystem and is flooding around the large enterprise customers using the other object storage suppliers’ products.

And they are reacting. Scality is rewiring its object storage to be cloud-native in the form of Artesca — following MinIO’s lead, as Periasamy might see it.

Next phase of growth

Periasamy said: “Private cloud is our engine as we grow. MinIO’s binary is small, less than 100MB. It fits on a Raspberry Pi. It’s great for the edge and powerful enough for the middle and the data centre.”

Enterprises have a problem, as they need, Periasamy says: “a consistent object storage system to run everywhere; edge, data centre, public cloud, and private cloud. That’s what’s driving our growth today and I don’t see that changing. We’ve been enterprise ready for years and we’re already running storage at pretty major companies … We are well-positioned to win.”

MinIO has 140 paying customers for Subnet, its subscription network commercial license, which was launched in August last year. On the one hand, this is an absurdly low number for a supplier with well over 600,000 Docker Pulls. On the other hand it will be enterprises that pay for MinIO support — think Red Hat and Linux — and this is a reasonable total after only twelve months.

Our view is that MinIO has comparatively few enterprise-capable channel partners, compared to an outfit like Red Hat with more than 2000. This is changing.

Periasamy says MinIO has a strong OEM business. “Lyve Cloud for Seagate is powered fully by MiniO … There’s been an acceleration of paying customers since we changed to the GNU Affero General Public Licence (AGPL) v3 in May. If you ship under AGPL v3 then use MIniO freely. If not, buy a commercial licence.

“Our software is simple to support and customers get 24×7 direct access to level 4 engineering support. That’s unique to MinIO.”

He then outlined a strength which is possibly also becoming a weakness: “We actually don’t have sales people. All our business is in-bound. There are no sales engineers. We have marketing, engineering and documentation. That is a very different model — a digital one. It played well in the pandemic.”

Bottom-up market capture

In Periasamy’s view: “NAS shifting to object storage is a clear trend. Modern SW stacks are designed to use S3-only object storage. They can’t run on file — and SAN is shifting to NVMeoF.

“GCP and Azure Blob is okay for mono-cloud but you need S3 for AWS mono-cloud, for multi-cloud and for hybrid on-premises-cloud.”

We think the progress of S3 can be seen as a bottom-up capture of the object storage market. Periasamy draws a parallel with Microsoft Windows: “See how Microsoft’s desktop GUI destroyed the Unix desktop. Without Windows Microsoft wouldn’t have won the server market.

“People can’t simply download other object storage, but they can pull MinIO straight from Docker. Land-grabbing is important to us. We are building a long-term sustainable brand. MinIO is Hotel California without strings.”

The next round

MinIO was founded in 2014 and has 42 employees. It is still using cash from its 2017 $20 million Series A funding. Periasamy said: “We’ll raise a Series B in the not too distant future. We have a lot of flexibility [and] we’re not talking about profitability.” There is a lot of preliminary investor interest and he also said: “The next round will be a big one.”

Our view is that a slice of that cash will be pointed towards the partner network, and MinIO’s partner infrastructure and be used to grow MinIO’s overall enterprise selling capability. The company has a massive groundswell of support and use but comparatively — we stress “comparatively” — little enterprise usage. Not compared to its Docker Pull numbers. Cloudian, Scality, NetApp and IBM surely each have more enterprise customers than MinIO has paying customers.

That’s MinIO’s challenge: enterprise catchup with its competitors. It may be possible, using its ability to provide a consistent object storage experience across all the computing platforms an enterprise uses and its extraordinary presence in the wider object storage community. That, and its software’s performance.

Did anyone say MinIO equals MaxIO? It’s abut time they did.

"Smartphone" - Google News

August 09, 2021 at 10:15PM

https://ift.tt/3AvE998

MinIO: the smartphone camera of object storage – Blocks and Files - Blocks and Files

"Smartphone" - Google News

https://ift.tt/2QXWyGT

https://ift.tt/2KSW0PQ

Bagikan Berita Ini

0 Response to "MinIO: the smartphone camera of object storage – Blocks and Files - Blocks and Files"

Post a Comment