May 9, 2023

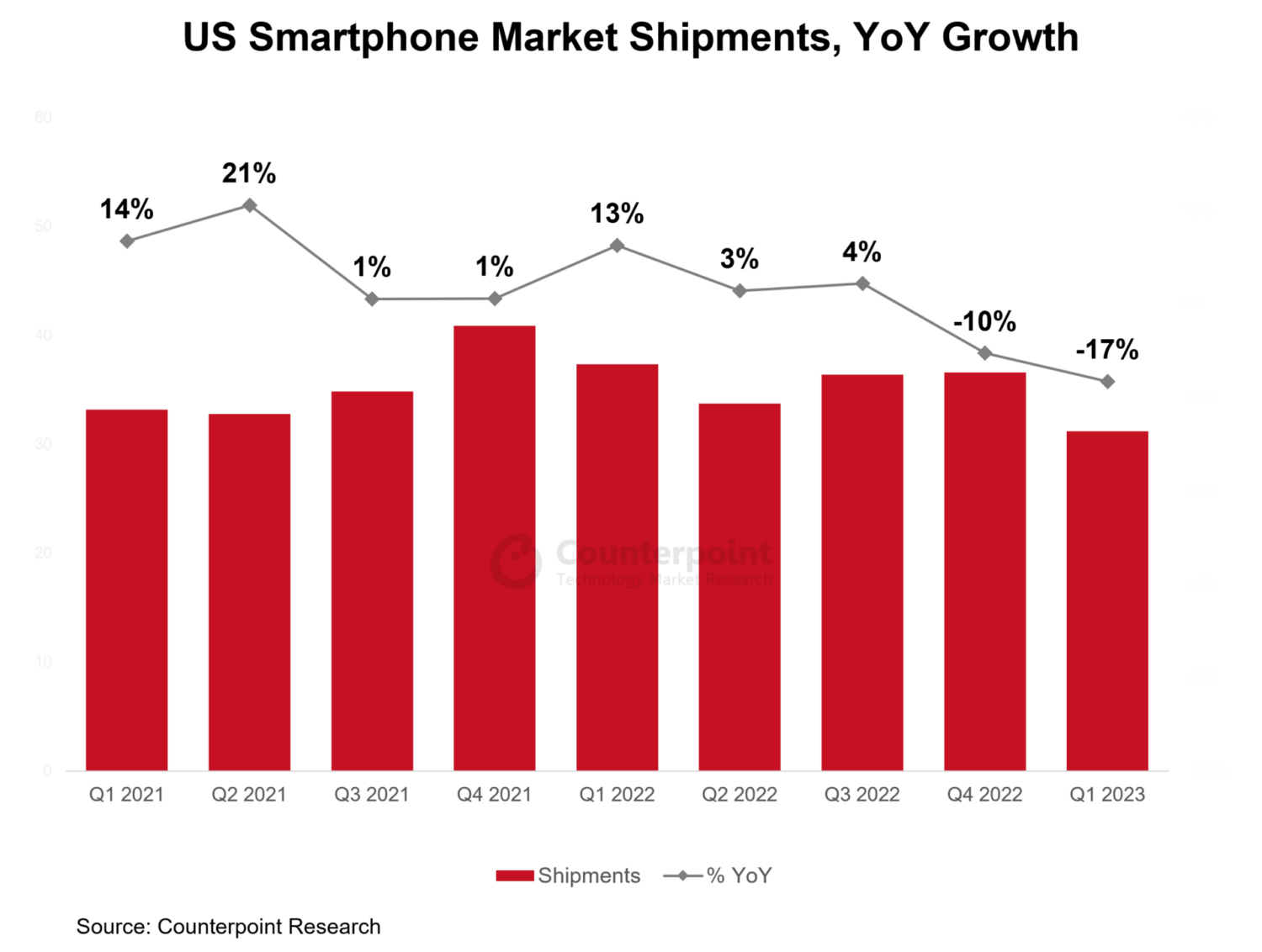

- Shipments declined 17% YoY in Q1 2023 due to inventory correction and weak consumer demand.

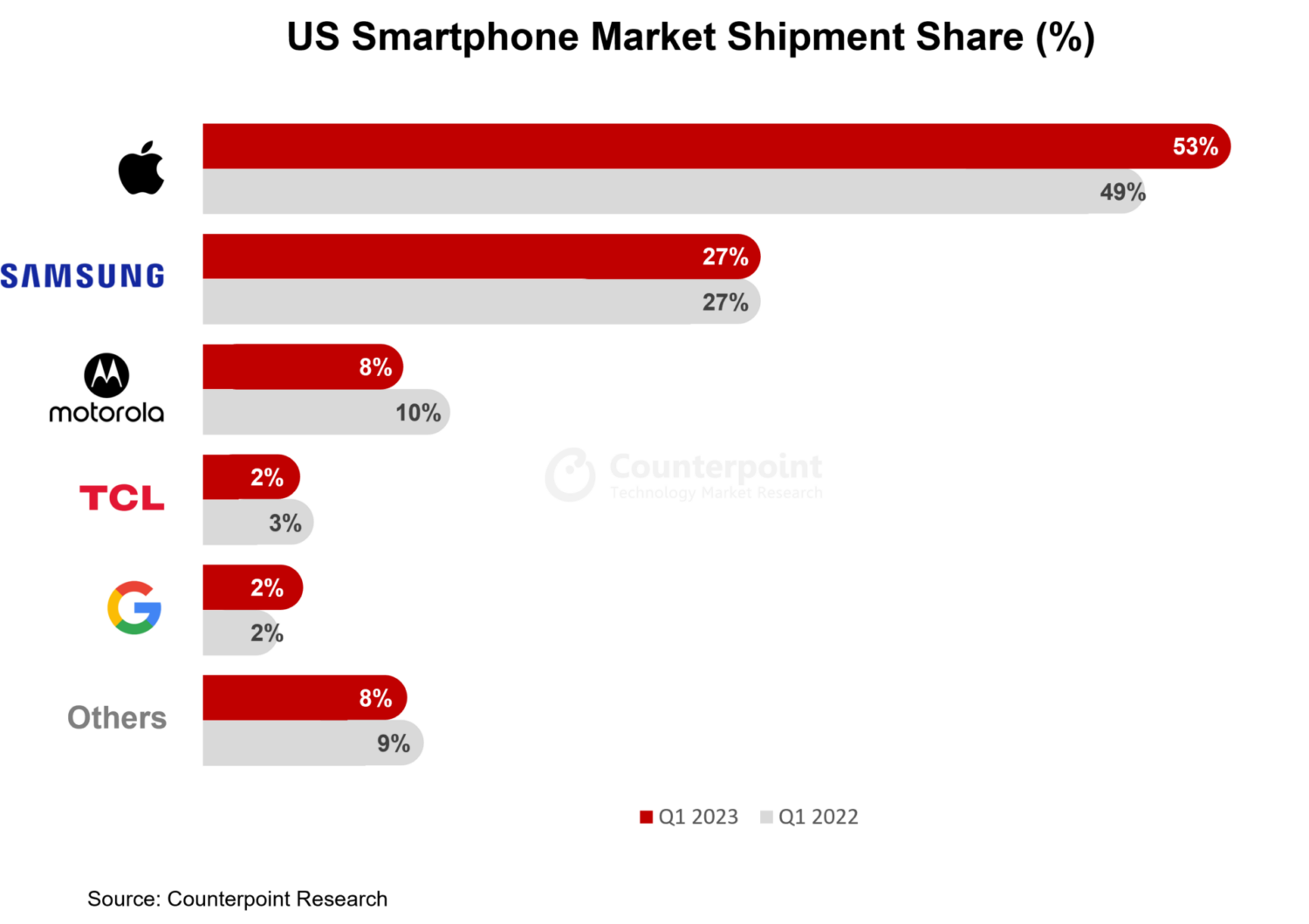

- Apple increased its market share to 53% in Q1 2023 from 49% in Q1 2022.

- The uncertain economic outlook forced consumers to hold off on new device purchases.

- Some niche categories like foldables may continue to perform well despite overall weakness.

- Incumbent postpaid players may increase promotional activity during H2 to take on cable MVNOs.

Denver, Boston, Toronto, London, New Delhi, Hong Kong, Beijing, Taipei, Seoul – May 8, 2023

Smartphone shipments in the US declined 17% YoY in Q1 2023 as OEMs corrected high channel inventory and as consumer demand declined due to macroeconomic pressures. The market witnessed a dip in shipments across all major OEMs after registering a strong first quarter last year. However, Apple managed to increase its market share despite a YoY drop in its shipments.

Commenting on the situation, Research Analyst Matthew Orf said, “Inflation started impacting the US smartphone market in H2 2022, especially the low end where consumers have less disposable income and are more sensitive to changes in prices. Persistent inflation and an uncertain economic outlook are causing consumers to hold off on new device purchases, resulting in lower upgrade rates and fewer device sales, especially in the prepaid segment.”

The impact of inflation and other macroeconomic pressures on the market has been uneven. Senior Analyst Maurice Klaehne noted, “While prepaid brands saw significant YoY declines in shipments, there were some silver linings. Samsung’s Galaxy S23 shipments were up double digits YoY while the Galaxy A14 5G performed exceptionally well in prepaid. The gap between low-end and premium devices seems to be widening, creating a vacuum in the mid-range device category.”

Associate Research Director Hanish Bhatia noted, “Some niche categories may continue to perform well despite overall weakness. For instance, there is a lot of excitement around foldables this year as more OEMs jump onto the bandwagon, which may stir demand for premium devices. Similarly, demand from government-supported Lifeline and ACP programs will largely remain unaffected. But at a broader level, Android-to-iOS migration driven by young and first-time smartphone users continues to remain a key pain point among Android OEMs.”

Commenting on the direction of the US smartphone market, Director of North America Research Jeff Fieldhack said, “During Q1 2023, there was sluggish consumer demand with very low upgrades. We expect the incumbent postpaid players to increase promotional activity during the second half of the year to combat cable MVNOs, which saw higher net additions than the Big 3 during the quarter, a first for the US market.”

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the technology, media and telecom (TMT) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Matthew Orf

Maurice Klaehne

Hanish Bhatia

Jeff Fieldhack

Follow Counterpoint Research

Further Reading:

Global Smartphone Market Declines 14% YoY in Q1 2023; Apple Records Highest-Ever Q1 Share

China Smartphone Sales Fall 5% YoY in Q1 2023; Apple on Top with Highest Sales Share

India Smartphone Market Records Highest Ever Q1 Decline of 19%, 5G Smartphones Contribution at 43%

"Smartphone" - Google News

May 09, 2023 at 08:25PM

https://ift.tt/Pcdxmn6

US Smartphone Shipments Decline in Q1 2023 Amid High Inflation, Inventory Correction; Apple Share Up - Counterpoint Research

"Smartphone" - Google News

https://ift.tt/zSt8dDN

https://ift.tt/ZFgtCMN

Bagikan Berita Ini

0 Response to "US Smartphone Shipments Decline in Q1 2023 Amid High Inflation, Inventory Correction; Apple Share Up - Counterpoint Research"

Post a Comment