Shipments hit around 346 million last quarter as the industry continues to recover from the COVID-19 pandemic but faces other challenges ahead, say Canalys and IDC.

Image: iStock/ViewApart

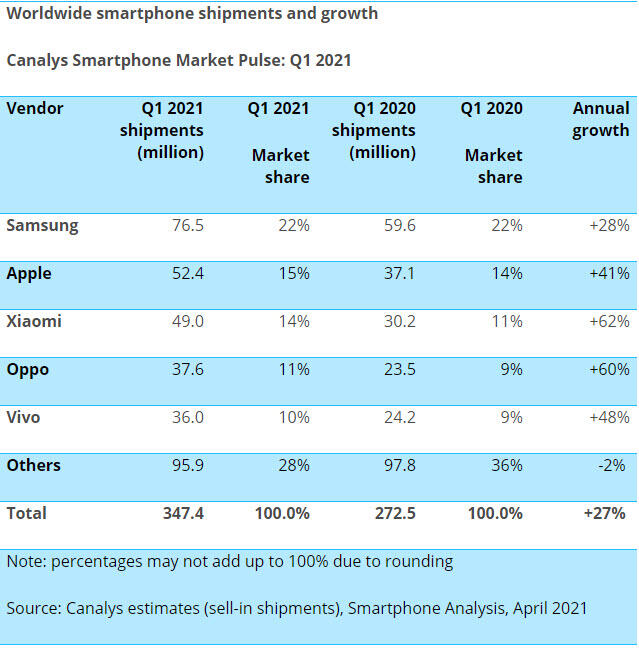

Smartphone shipments around the world surged by more than 25% during 2021's first quarter, an ongoing sign of recovery from the effects of the coronavirus outbreak. For the quarter, shipments rose by 27% to 347 million units, research firm Canalys said on Thursday, and by 25.5% to 346 million, according to fellow researcher IDC.

SEE: Research: How 5G will transform business (TechRepublic Premium)

The industry's recovery is accelerating quicker than expected, showing a healthy demand for smartphones throughout the world, IDC's Worldwide Mobile Device Trackers research director Nabila Popal said. All the major global regions have contributed to the stellar growth. But China and the rest of Asia-Pacific kicked in more than their fair share, accounting for gains of 30% and 28%, respectively.

Of course, the latest results compare last quarter with the first quarter of 2020, one of the worst in smartphone history. At the time, the pandemic was just starting, most of the supply chain was stuck in neutral, and China was in full lockdown mode.

"However, the growth is still very real," Popal added. "When compared to two years ago, shipments are 11% higher. The growth is coming from years of repressed refresh cycles with a boost from 5G. But above all, it is a clear illustration of how smartphones are becoming an increasingly important element of our everyday life."

Samsung took home the top spot last quarter with shipments of around 76 million and a market share of 22%. The company saw hefty demand for its new Galaxy S21 due largely to its decision to trim $200 off the price of its flagship phone. Apple came in second with shipments of 52 million-55 million and a 15-16% slice of the market. Though sales of the new iPhone 12 Mini have been lackluster, demand for other iPhone 12 flavors and the older iPhone 11 was solid.

Chinese vendors Xiaomi, Oppo and Vivo rounded up the top five. Xiaomi scored its best quarter ever, according to Canalys, shipping 49 million units, a gain of 62% from the prior year's quarter. Ben Stanton, Canalys research manager, pegged the company's strong growth on its efforts to recruit local talent, take greater advantage of retail channels, and capture a lead in high-end innovation. The Mi 11 Ultra and the foldable Mi Mix Fold have been successful product launches.

Image: Canalys

A big shift is also affecting the smartphone industry, opening up opportunities and challenges. Once the top player in China, Huawei has dropped to seventh place in the global marketplace, hurt by U.S. sanctions and the sale of its Honor phone brand.

To pick up the slack, Apple and Samsung have been scooping up buyers in the higher-end, while Xiaomi, Oppo and Vivo have been capturing customers in the low- and mid-priced segments. Among the Chinese vendors, Xiaomi is sizzling right now, though that status could change.

"The race is not over," Stanton said. "Oppo and Vivo are hot on [Xiaomi's] heels, and are positioning in the mid-range in many regions to box Xiaomi in at the low end. Honor is also a looming threat. It has already struck supply chain deals and is now signing distribution agreements to re-enter several markets in the second half of 2021. Xiaomi is leading the pack, but the race has only just started."

At the same time, LG recently announced that it's exiting the phone business. Canalys analyst Sanyam Chaurasia called this move a symbol of a new era in the smartphone business, showing that aggressive pricing and channel strategy are more important than hardware features. LG's exit will trigger openings for other players.

"LG holds the majority of its share in the Americas, at 80% of its total in 2020, which presents new opportunities for the likes of Motorola, TCL, Nokia and ZTE, particularly at price points below $200," Chaurasia said. "As the smartphone market continues to consolidate, this will not be the last time the incumbent vendors fight over the remains of a defeated brand."

Looking further ahead, COVID-19 will still be a concern for the industry but no longer the major obstacle, according to Stanton. Supply constraints of chipsets and other components will impact smartphone shipments this year. As such, smartphone vendors will have to rethink their product strategies.

"Some brands, for example, have de-prioritized device shipments in India amid the new COVID-19 wave, and instead are focusing efforts on recovering regions, such as Europe," Stanton said. "And while the shortages persist, it will grant larger companies a unique advantage as the global brands have more power to negotiate allocation. This will put further pressure on smaller brands and could force many to follow LG out of the door."

Also see

"Smartphone" - Google News

May 03, 2021 at 09:57PM

https://ift.tt/3gX6PBv

Global smartphone shipments jump more than 25% in first quarter of 2021 - TechRepublic

"Smartphone" - Google News

https://ift.tt/2QXWyGT

https://ift.tt/2KSW0PQ

Bagikan Berita Ini

0 Response to "Global smartphone shipments jump more than 25% in first quarter of 2021 - TechRepublic"

Post a Comment